November 2, 2025 | Mark Luis Foster

A recent report from Realtor.com showcases growing housing inventory across the nation, with sluggish sales. Mortgage rates have fallen but remain stubbornly above acceptable levels for many buyers.

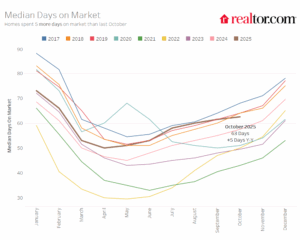

Despite falling mortgage interest rates over the past few months, the housing market’s pace remains slow. Homes spent longer on the market for the 19th straight month, with the slowdown most pronounced in Florida and the West. List prices nationally were flat year over year but slipped in the South and West, with regional differences starker when measured on a per-square-foot basis.

The report outlines significant differences in US regions, with housing inventory increasing in October; however, the pace of that growth has slowed recently.

- West: +17.4%

- South: +17%

- Midwest: +12.2%

- Northeast: +8.9%

The pandemic has been a common pivot point of comparison to show before and after contrasts in housing activity. The Midwest numbers are dismal.

For October, inventory in the West (+3.2%) and South (+4.6%) remains above pre-pandemic norms, while the Midwest (-35.7%) and Northeast (-48.6%) continue to lag significantly. At the national level, recovery vs. pre-pandemic has effectively stalled—largely driven by the relative slowdown in the West, where inventories this summer were as large as 11.4% above pre-pandemic norms.

In Minneapolis, which we take to be the “Minneapolis geographic area,” overall numbers are down from May-October 2025 when compared to pre-pandemic levels, some 22% behind those days.

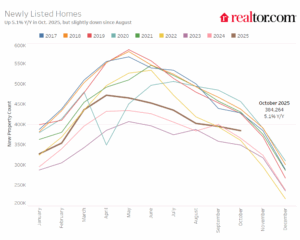

The chart below shows newly listed homes since 2017; the thick brown line in the middle shows this year’s data. But it’s slow out there. Townhomes, condos and single family homes are on the market for a long time in this high interest rate environment.

And this chart shows the number of days on market; nationally higher average days, and still not at the top of some past years.

Read the story and see all the charts HERE.